Dividend Engine

Turn yield from your real-world assets into automated, pro-rata token distributions. Our platform provides the end-to-end institutional plumbing for predictable, on-chain income.

The Barriers Smart Dividents Breaks

The Four Pillars of Automated Income

Stable Token & Treasury

Issue stable-priced tokens backed by your yield-bearing assets.

Automated Distribution

Let smart contracts automatically distribute income to holders.

On-Chain Transparency

Give investors a real-time, auditable record of all earnings.

Integrated Compliance

Enforce all investor and jurisdictional rules on every payout.

Stable Token & Yield Treasury

Issue stable-priced tokens for predictable accounting.- Configure tokens to be pegged to a fixed value (e.g., $1.00), so the principal value never fluctuates.

- The token's value is backed by your designated, low-risk, yield-bearing RWAs (like U.S. Treasury bills or regulated MMFs).

Simplify accounting and reduce investor anxiety by offering a stable-priced asset that only grows in balance, not in price.Automated Distribution Engine

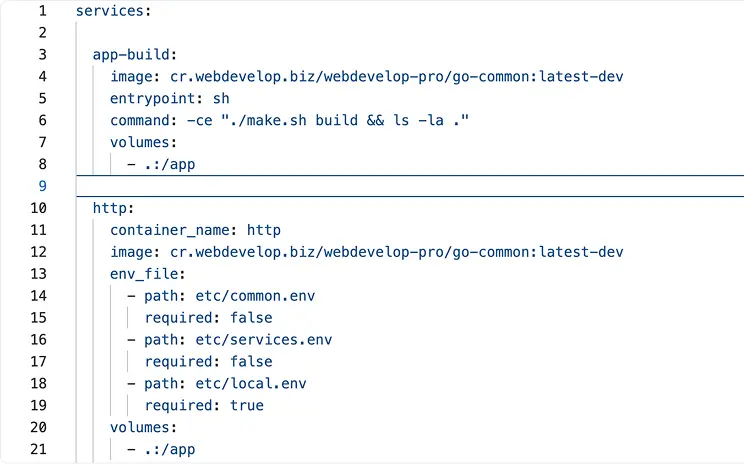

Replace manual spreadsheets with a "set it and forget it" smart contract.- Earnings from your assets are streamed into the smart contract, which calculates pro-rata shares in real time.

- The contract automatically issues new tokens representing each holder's share of the yield.

- Set any cadence, cut-off time, or reserve logic to fit your specific fund strategy.

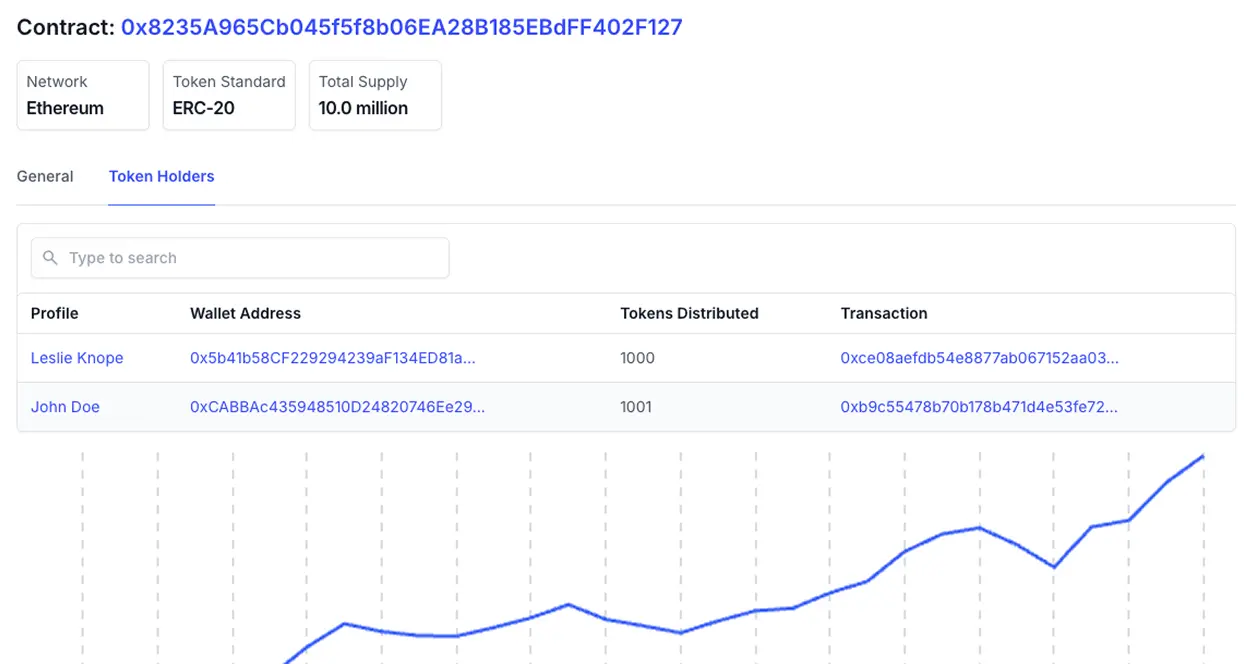

Completely eliminate manual, spreadsheet-based payout management. Zero operational lag, no admin cycles.On-Chain Transparency & Audit

Build investor trust with verifiable, on-chain proof.- Every single payout is an immutable transaction, fully auditable and visible on a block explorer.

- Investors can literally watch their wallet balance increase, confirming that the yield is real and being paid.

Build institutional trust through verifiable transparency. This clarity leads to happier limited partners (LPs) and fewer support tickets.Integrated Compliance

Enforce all rules at the token level, not in a spreadsheet.- Every dividend distribution automatically respects the token's built-in compliance rules.

- The smart contract checks KYC/AML status, jurisdictional rules, and investor type before sending a single token.

Ensure every distribution is 100% compliant by design, eliminating the risk of paying a sanctioned or ineligible holder.

At-a-Glance: Income vs. Growth

| Dividend-Paying (Income) | Price-Appreciating (Growth) | |

|---|---|---|