Tokenization Engine

Winners won’t just issue tokens - they’ll own the rails. We build these rails. This is the end-to-end infrastructure to program, issue, and manage compliant digital securities on-chain.

The Barriers Tokenization Rails Engine Breaks

The Six Stages of Tokenized Infrastructure

STEP 1

Structure

STEP 2

Comply

STEP 3

Tokenize

STEP 4

Distribute

STEP 5

Manage

STEP 6

Trade

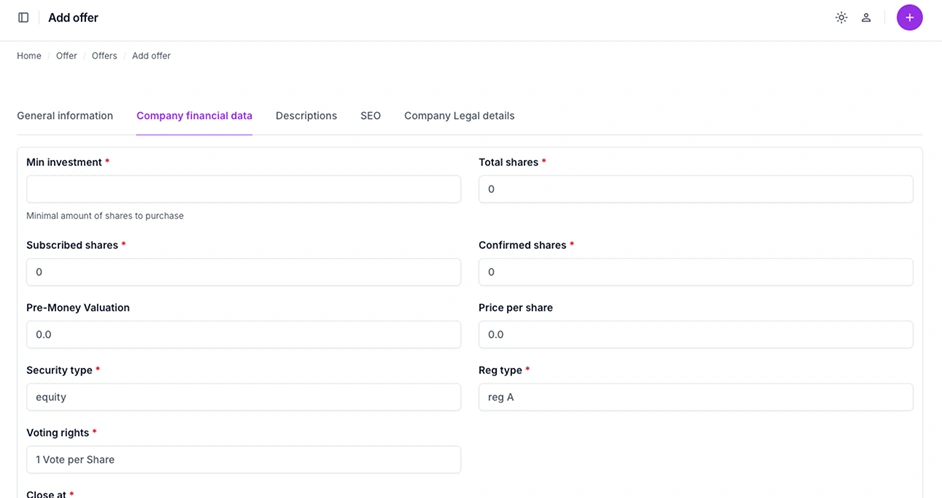

Issuer Console & Structuring

Templatize legal structures, terms, and cap tables.- Utilize a toolkit for legal structuring, terms, and instrument parameters.

- Configure for multiple exemptions/registrations (Reg D, Reg A, etc.).

- Manage cap table and ownership data in one unified console.

Launch offerings faster with 30-60% lower operational overhead on repeat issuances.Compliance‑By‑Design Engine

Enforce transfer rules at the token level, not after the fact.- Hard-code transfer rules (KYC/AML, investor type, lockups) directly into the token.

- Grant issuer-appointed agent controls (freeze, force-redeem) for sanctions events.

- Integrate institutional custody options (qualified custodians, MPC).

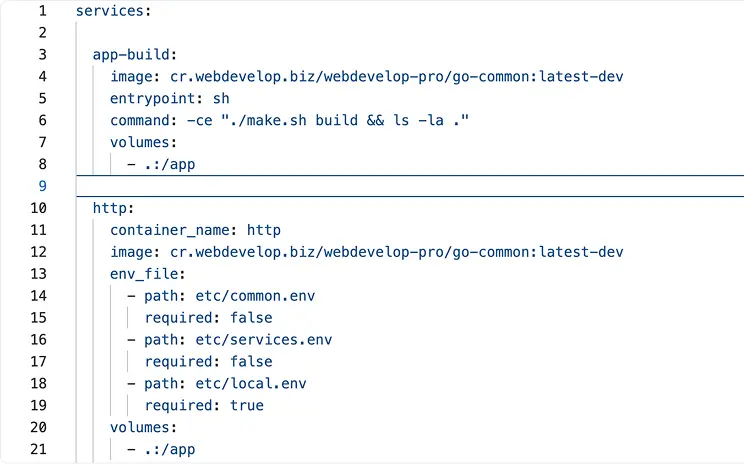

Achieve pre-trade enforcement and a regulator-ready, auditable ledger.Programmable Asset Engine

Automate the entire asset lifecycle with smart contracts.- Deploy smart contracts for coupons, dividends, redemptions, and buybacks.

- Automate vesting, amortization, and other complex lifecycle events.

- Enable T+0 corporate actions with fewer reconciliations.

Eliminate manual post-issuance operations and costly reconciliation errors.Atomic Settlement Hub

Enable instant delivery-versus-payment on-chain.- Enable true delivery-versus-payment (DvP) settlement for primary and secondary transfers.

- Utilize tokenized cash or integrated settlement tokens.

- Provide a clear, auditable reconciliation for all fund movements.

Move from T+2 to T+0 settlement, reducing counterparty risk and freeing up capital.Live Disclosure Ledger

Build investor trust with real-time, immutable transparency.- Provide an immutable, time-stamped log of all filings and material events.

- Offer live use-of-proceeds and asset performance dashboards.

- Link all material data directly to the token itself.

Drive more bids and tighter spreads with machine-readable, real-time data.Liquidity & Venue Connectors

A built-in, licensed trading venue for your tokenized assets.- Integrate with licensed secondary venues (ATSs) and programmatic RFQs.

- Ensure investor whitelist portability across different marketplaces.

- Deploy composability-ready wrappers for institutional DeFi.

Provide your investors with 24/7 venue optionality and compliant transfer controls.

Traditional vs Tokenized Assets

| Traditional | Tokenized | |

|---|---|---|