Investor funds protection

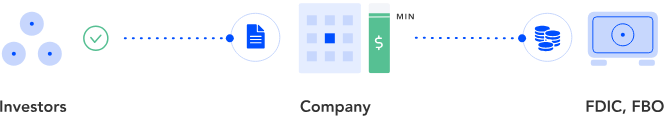

SEC mandates that funds raised during the campaign are held in escrow until the offering reaches its minimum target. Only after this target is met can funds be transferred to the issuer. Issuers must work with an SEC-registered escrow agent or a third-party escrow service provider with a FDIC-insured FBO account, ensuring an added layer of security and transparency.

Upon reaching its minimum fundraising target, the investment company facilitated the transfer of capital from the third-party FDIC-insured FBO account to its own accounts. Subsequently, the company issued purchased securities to each of the investors.

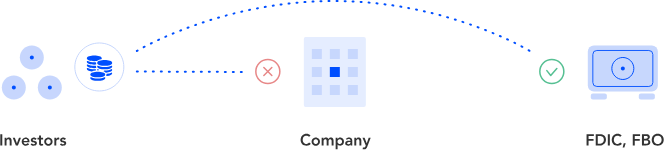

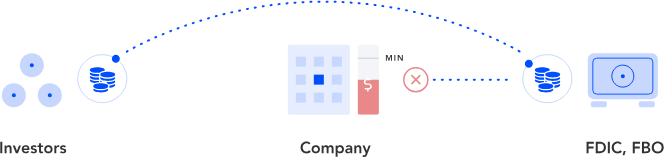

In the event that a company failed to reach its minimum fundraising goal, all commitments were promptly returned from the third-party FDIC account to the respective investors. The product was designed without any hidden fees or accrued interest.

Seamlessly integrating these services and ensuring timely fund release adds complexity to transaction handling.